AUDIOCODES (AUDC)·Q4 2025 Earnings Summary

AudioCodes Beats on AI Momentum: ARR Up 22%, Dividend Declared

February 3, 2026 · by Fintool AI Agent

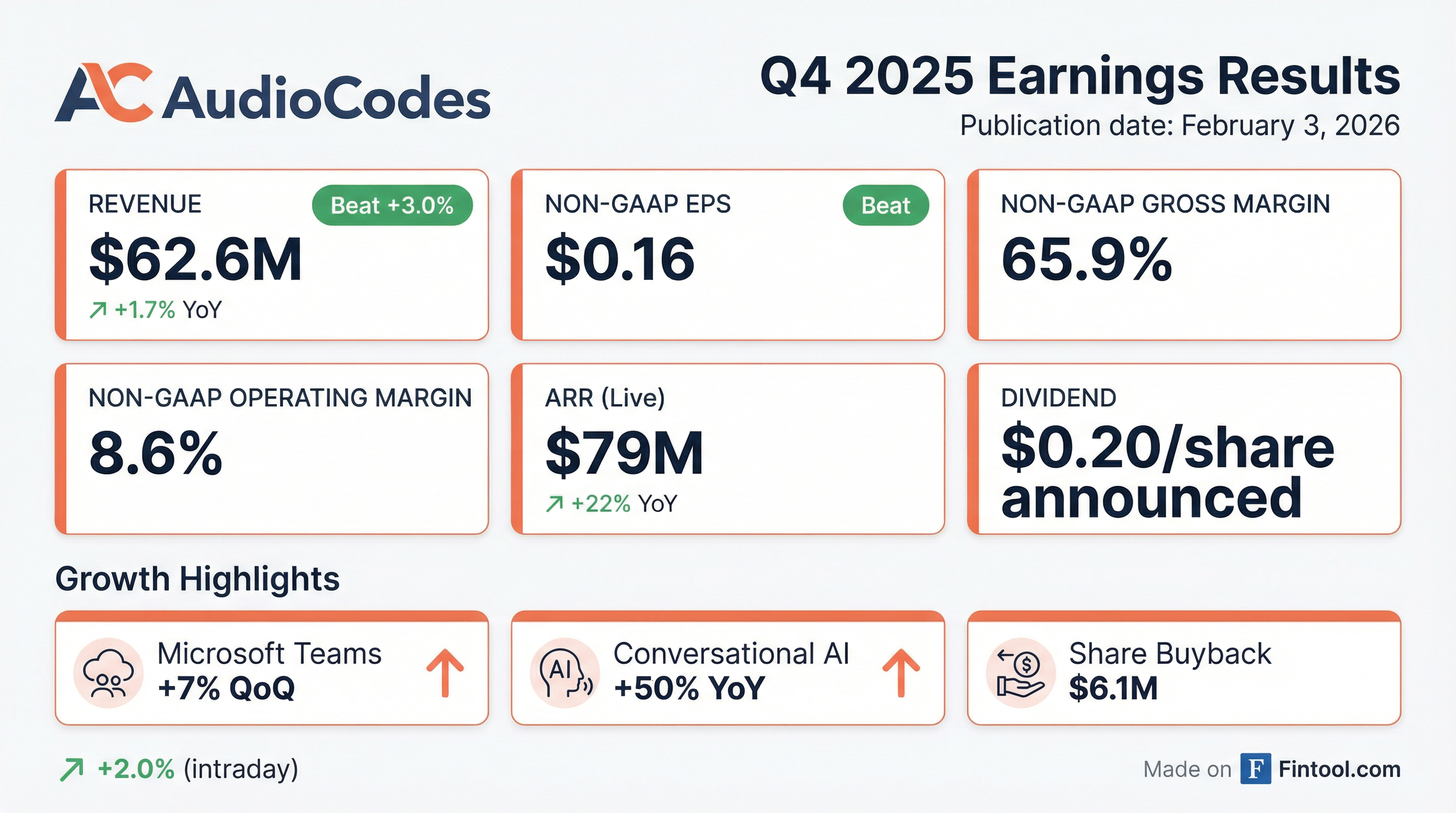

AudioCodes (NASDAQ: AUDC) delivered a beat on both revenue and earnings in Q4 2025, driven by accelerating momentum in conversational AI and managed services. The Israeli enterprise voice solutions provider posted revenue of $62.6M (+1.7% YoY) and Non-GAAP EPS of $0.16, while announcing a $0.20 semi-annual dividend and continued aggressive share repurchases.

The quarter's highlight was the 50%+ YoY growth in conversational AI revenue, with the broader AI portfolio expanding 35% for full-year 2025. Annual Recurring Revenue (ARR) from the Live managed services platform reached $79M, up 22% YoY, with management targeting $92-98M for 2026.

Did AudioCodes Beat Earnings?

Yes — AudioCodes beat on both revenue and EPS.

Revenue of $62.6M beat consensus by approximately $1.8M, marking the first revenue beat in several quarters. Non-GAAP EPS of $0.16 came in ahead of the $0.155 Street estimate, though down significantly from $0.37 in Q4 2024 (which included a $0.21/share tax benefit).

Margin Performance:

Operating and EBITDA margins compressed YoY due to higher operating expenses, particularly in selling and marketing (+6.3% YoY), as the company invests in its AI and cloud transformation.

What Did Management Guide?

AudioCodes provided explicit FY2026 guidance alongside ARR targets:

CEO Shabtai Adlersberg provided a longer-term target: Voice AI revenue of $50M by 2028, implying 40-50% annual growth from the current ~$17M base. Management expects the Voice AI business to reach breakeven in 2 years as scale improves.

The guidance assumes continued strong Voice AI growth (40-50%) and stable connectivity outlook, with no significant macroeconomic changes. Management highlighted tariff-related costs of ~$2.3M expected in 2026, down from $2.7M in 2025.

What Changed From Last Quarter?

Key sequential changes:

-

Microsoft Teams accelerated — Revenue from the Teams business increased 7% QoQ. The Teams ecosystem is healthy: PSTN users grew from 20M (April 2024) to 26M (+16-17% YoY), with 80-100M pre-licensed C5 users representing the immediate addressable market

-

Connectivity recovery in North America — Management noted "resurgence in demand triggered by the renewed focus on the PSTN shutdown trend in NA"

-

Margin stabilization — After Q2's dip to 7.2% operating margin, margins recovered to 8.6% in Q4, though still well below the 12.2% in Q4 2024

-

ARR momentum sustained — ARR grew to $79M (+22% YoY), up from ~$65M at Q4 2024 exit, with trajectory toward $92-98M by end of 2026

-

Cisco Webex Calling partnership announced — AudioCodes now offers end-to-end certified voice solutions for Cisco Webex Calling (18M+ users globally), opening a major new connectivity opportunity beyond Microsoft Teams

How Did the Stock React?

AudioCodes shares rose +2.0% during regular trading following the earnings release, closing at $8.52. After-hours trading showed shares pulling back to $8.32 as of the latest print.

Key trading levels:

The stock trades near its 52-week low, down ~33% from its 52-week high, reflecting broader concerns about the pace of the company's transformation and margin compression during the investment phase.

Business Unit Structure

AudioCodes breaks down into two distinct business units with different economics:

The Connectivity business is mature and profitable, while Voice AI is in investment mode with an annual budget burn of $9-10M. Management is reallocating R&D resources aggressively: out of 350 R&D employees, 150 now work on Voice AI (up from 40-50 when the initiative started). Total headcount reached 981 at year-end, up from 946 at end of 2024.

AI Business Deep Dive

AudioCodes' conversational AI business was the standout performer:

Key Q4 Contract Wins:

- AT&T — 36-month contract for a large public university, including managed gateway, SBC, calling plans, and IP phones (migrating from Cisco)

- European Equipment Manufacturer — 60-month deal starting with 2,000 users, full migration from Cisco to Teams Voice

- Atento (Top 5 Global BPO) — 500+ concurrent AI voice agents for a large healthcare organization, deployed in weeks vs. typical 3-6 months

- Israeli Government Nimbus Contract — First deal signed with multiple ministries in pipeline; C5 security approval received

New Product Developments:

- Meeting Insights added Google Meet support (Q4); Cisco WebEx expected Q1 2026

- Mia-OP (on-prem Meeting Insights) expanding from 2 to 10 supported languages in Q1

- Agent Insights launched — GenAI summaries, sentiment analysis, one-click CRM updates

The company serves 65 of the Fortune 100 and 9 of the Fortune Top 10 enterprises.

Capital Allocation

AudioCodes continues returning capital to shareholders through buybacks and dividends:

Dividend: $0.20/share semi-annual dividend declared (~$5.4M total), payable March 6, 2026. Subject to 25% Israeli withholding tax (30% for 10%+ holders).

Buybacks: Repurchased 667,193 shares for $6.1M in Q4, at an average price of ~$9.14/share. The company has $20.6M remaining under its court-approved $25M buyback authorization through April 2026.

Balance Sheet:

Cash declined $18.2M YoY due to $30.6M in share repurchases and $10.9M in dividends, partially offset by operating cash flow.

Full Year 2025 Summary

Key Risks and Concerns

-

Margin pressure — Operating margins have compressed from 12.2% (Q4 2024) to 8.6% (Q4 2025) as the company invests in transformation

-

Geopolitical exposure — AudioCodes is headquartered in Israel with ongoing regional conflict risks; military service obligations affect some personnel

-

Cash consumption — Cash position down 19% YoY while buybacks and dividends continue

-

Profitability vs growth trade-off — Non-GAAP EPS down 30% YoY despite revenue growth, raising questions about operating leverage

Q&A Highlights

Josh Riley (Needham) asked about the 40-50% Voice AI growth target through 2028. CEO Adlersberg responded:

"The number of potential customers should grow... I'll use a word I'm not using usually. It will grow dramatically, I expect, in certain areas."

He emphasized growth will come from both new customer acquisition and expansion. Several AI products reached maturity in 2025, and the company is now scaling sales resources after holding back to ensure product readiness.

On pipeline visibility, Adlersberg noted SaaS applications enable faster POC-to-production cycles (30-60 days vs. 3-9 months for connectivity deals), improving visibility.

Forward Catalysts

- 2026 guidance execution — $247-255M revenue and $0.60-$0.75 EPS provide clear benchmarks

- Voice AI 2028 target — $50M revenue target implies 40-50% CAGR from current $17M base

- Cisco Webex Calling — New certification announced for end-to-end Webex Calling portfolio; Cisco has 18M+ Webex Calling users globally

- ARR trajectory — $92-98M 2026 target vs. $79M current; quarterly progress key

- Voice AI breakeven — Expected in 2 years as scale offsets $9-10M annual burn